Woodside Energy has agreed to buy a troubled US company with a fully permitted liquefied natural gas facility in development in the Gulf of Mexico in a $US900 million ($A1.4 billion) acquisition.

Australia's biggest LNG company announced on Monday that it would take over Houston-headquartered Tellurian for $1 a share, a 75 per cent premium to the New York Stock Exchange-listed company's share price from Friday.

The company had been struggling to find financing for its Driftwood LNG project near Lake Charles, Louisiana, a $US25 billion project with permits to produce 27.6 million tonnes per annum of LNG for export.

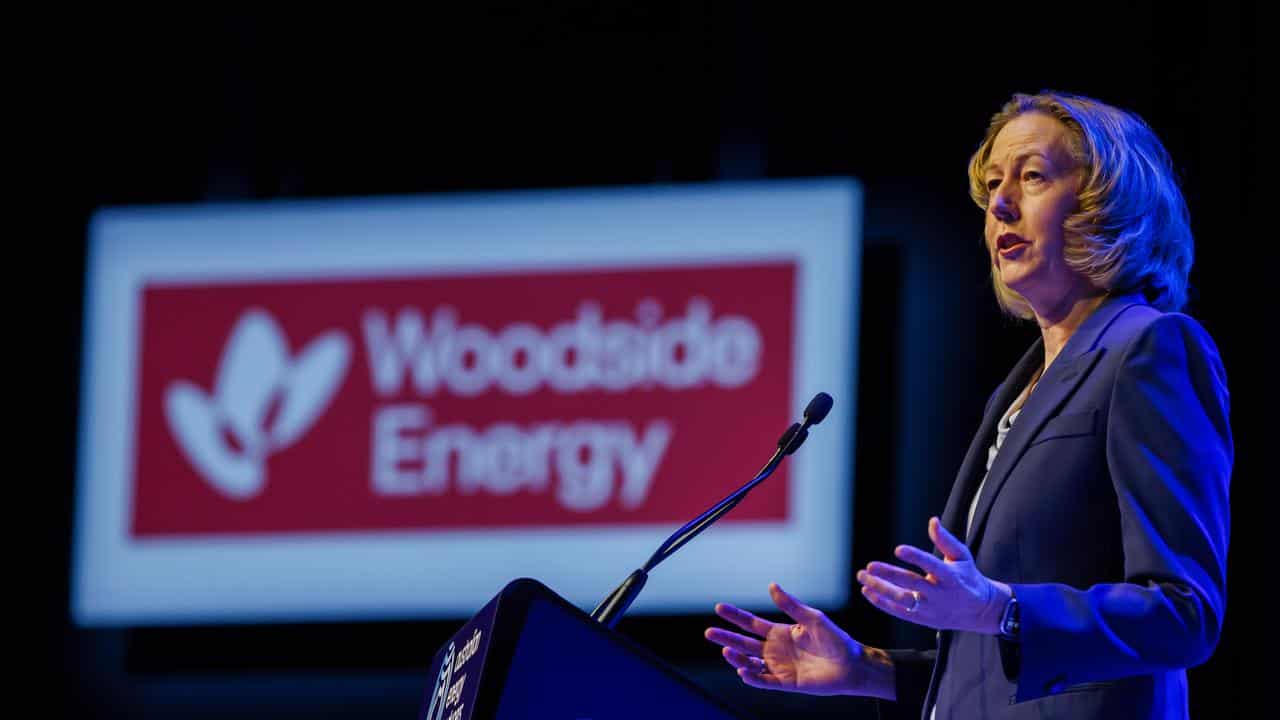

"The acquisition of Tellurian and its Driftwood LNG development opportunity positions Woodside to be a global LNG powerhouse,” said Woodside CEO Meg O’Neill.

It adds a scalable US LNG development opportunity to Woodside's LNG production in Australia, allowing the company to better serve customers globally and capture marketing optimisation opportunities across both the Atlantic and Pacific Basins, Ms O'Neill said.

Woodside is aiming to make a final investment decision on proceeding with the first stage of Driftwood's development in the first quarter of next year. Construction has already commended, with some foundation work in progress.

Tellurian has been through a number of management changes in recent months as it tried to keep the Driftwood project alive.

Co-founder and chairman Charif Souki was ousted in December and chief executive Octavio Simoes stepped down in March as Tellurian began looking to possibly sell itself.

Executive chairman Martin Houston said Tellurian's board had weighed its options and decided Woodside's "attractive offer" outweighed the risk and uncertainty of going it alone.

"Woodside is a high-quality operator, with better access to the substantial financial resources required to launch an LNG project and a greater ability to manage offtake risk," Mr Houston said.

But Alex Hillman, lead analyst of the Australasian Centre for Corporate Responsibility, said the acquisition just added to the risk around Woodside's emissions and capital expenditure on fossil fuels.

“Like Browse, Driftwood is a project that has struggled to get off the ground for years," he said, referring to Woodside's long-delayed Browse gas project off Western Australia's northwest coast.

"Questions should be raised as to why a super major has not already swooped in on the project," Mr Hillman continued, meaning the likes of ExxonMobil, Chevron and BP.

"Clearly, these companies do not see Driftwood as the compelling opportunity that Woodside claims it is."

Mr Hillman called it an "alarming strategic decision" to double down on LNG when the International Energy Agency warned last October of a possible LNG glut over the next few years.

Woodside said Driftwood's design was both cost and carbon competitive and the project had the potential to reduce the average emissions intensity of Woodside's LNG portfolio.

"Through this acquisition, we are delivering on our strategy to thrive through the energy transition," Ms O'Neill said.

"Woodside believes that LNG will play a key role in the energy transition and is well positioned to deliver the energy the world needs while delivering significant value to our shareholders."

Woodside shares were down 2.7 per cent at $28.425 on Monday afternoon.