Westpac has apologised for emailing a bank closure notice to a rural South Australian council addressed to Mr Bean, acknowledging it mixed up two communities with the same name.

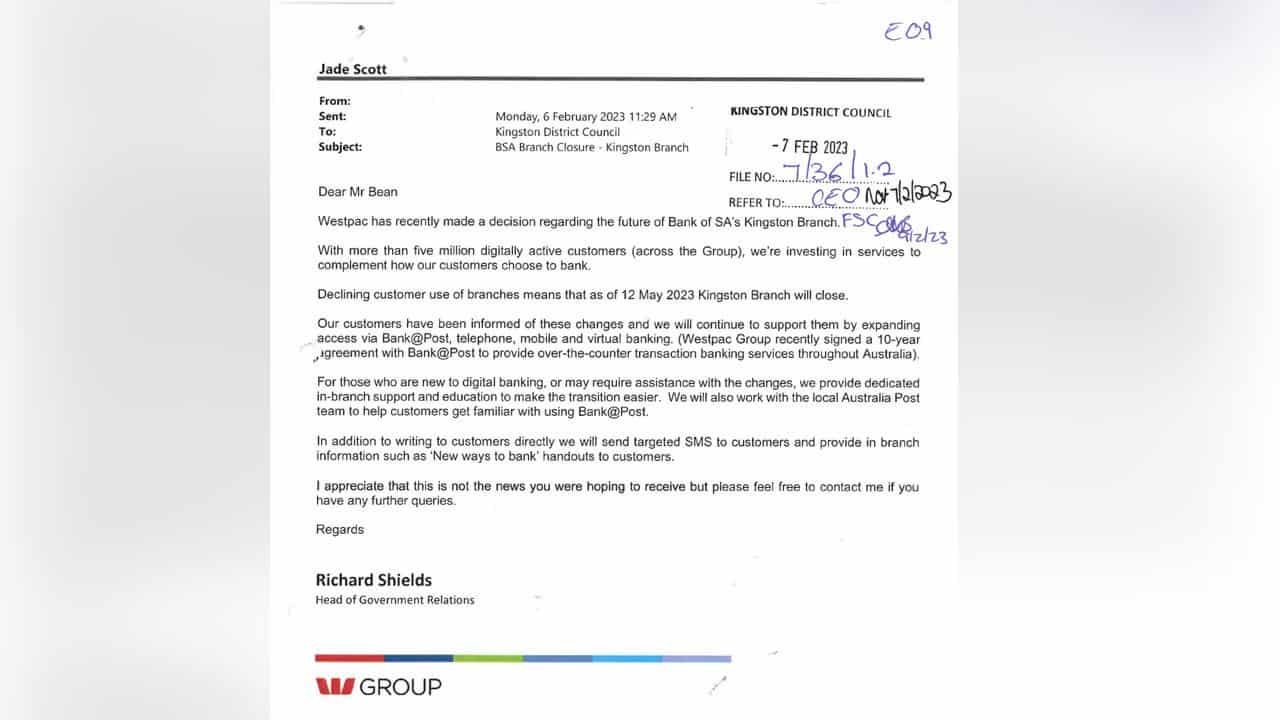

The bank emailed the notice headed "Dear Mr Bean" to Kingston District Council in February 2023, advising it would close the town's BankSA branch.

But there was no Mr Bean working at the council on the Limestone Coast, chief executive Ian Hart told a federal inquiry into rural bank closures on Wednesday.

"I'm not sure how that would have happened, that's embarrassing," Mr Hart told the committee, sitting in Kingston.

Westpac group chief customer engagement officer Ross Miller acknowledged it mixed up councils, with Peter Bean the chief executive of the City of Kingston in Melbourne.

"We apologise to the chief executive of Kingston council, but also to Peter Bean at Kingston in Victoria," Mr Miller said.

He said Westpac had improved its communications and spoke directly with councils when closing a branch.

It is one of many stories of the disconnect between the major banks and rural communities aired at the year-long Senate inquiry into branch closures.

The inquiry heard a Coober Pedy council staffer recently drove more than 500km to the nearest Westpac branch in Port Augusta to change account signatories, only to be told the manager could not see him that day.

"That's the treatment that we get," council administrator Geoff Sheridan told the committee.

The opal mining town lost its only bank when Westpac closed its branch in 2023, forcing residents to drive to Port Augusta or interstate to Alice Springs.

Mr Miller apologised for the staffer's experience but defended the bank's closures.

He said 96 per cent of Westpac's transactions were online, while three per cent of its 13 million customers used only face-to-face services.

"We have made the difficult decision to close branches that were under-utilised," Mr Miller said.

Nearly 800 regional and rural bank branches have shut across the nation since June 2017, according to the Australian Prudential Regulation Authority.

Banks point to the rapid take-up of online banking, along with a decline in cash transactions and foot traffic at branches.

But regional communities argue they are the centre of the nation's lucrative agriculture, energy and mining industries and should not lose essential services.

BankSA, a subsidiary of Westpac, shut the last bank in Mannum on the same day floods inundated the tourist village on the Murray River in December 2022.

"Every time a central service collapses it weakens the community," local Cathy Clemow said.

"My fear is that each collapse will weaken our backbone, our communities will become incapacitated and regions crippled and unable to achieve their full potential."

The inquiry has heard country people cannot always use digital banking as internet access is not necessarily reliable or affordable.

Professor Julian Thomas, from the ARC Centre of Excellence for Automated Decision-Making and Society, said accessibility should be at the core of banks' customer service values.

"That means ... not imposing unreasonable costs on customers, that they are affordable and inclusive in the sense that they should be available for all Australians."

The inquiry is due to report to parliament in May.