Billions of dollars more each year will go towards paying ballooning NSW state government debt as extra income from a buoyant property market fails to make up for a hit to the state's GST share.

The state's gross debt is expected to hit nearly $200 billion within four years, while it is also poised to receive a credit downgrade due to forecasts of persistent deficits.

Treasurer Daniel Mookhey said Tuesday's budget was a careful plan for difficult economic times as he delivered a statement awash in red ink for the foreseeable future.

A forecast surplus for the coming financial year has evaporated, replaced by an expected deficit of $3.6 billion in 2024/25.

The budget shortfalls are predicted to continue while gradually declining to $1.5 billion in 2027/28.

Mr Mookhey blamed the forecast deficits on an "absurd" annual GST carve-up that was taking billions from the state, a hit only partly made up for by higher revenue from several other sources.

The Commonwealth Grant Commission's decision would cost the state an expected $11.9 billion over the coming four years, turning a series of predicted surpluses into deficits.

"This budget gets the balance between making sure that the must-haves NSW can't go without get the investment they need at the same time we wrangle the state's debt under control so that we're in a better position to make better decisions for the future," Mr Mookhey said.

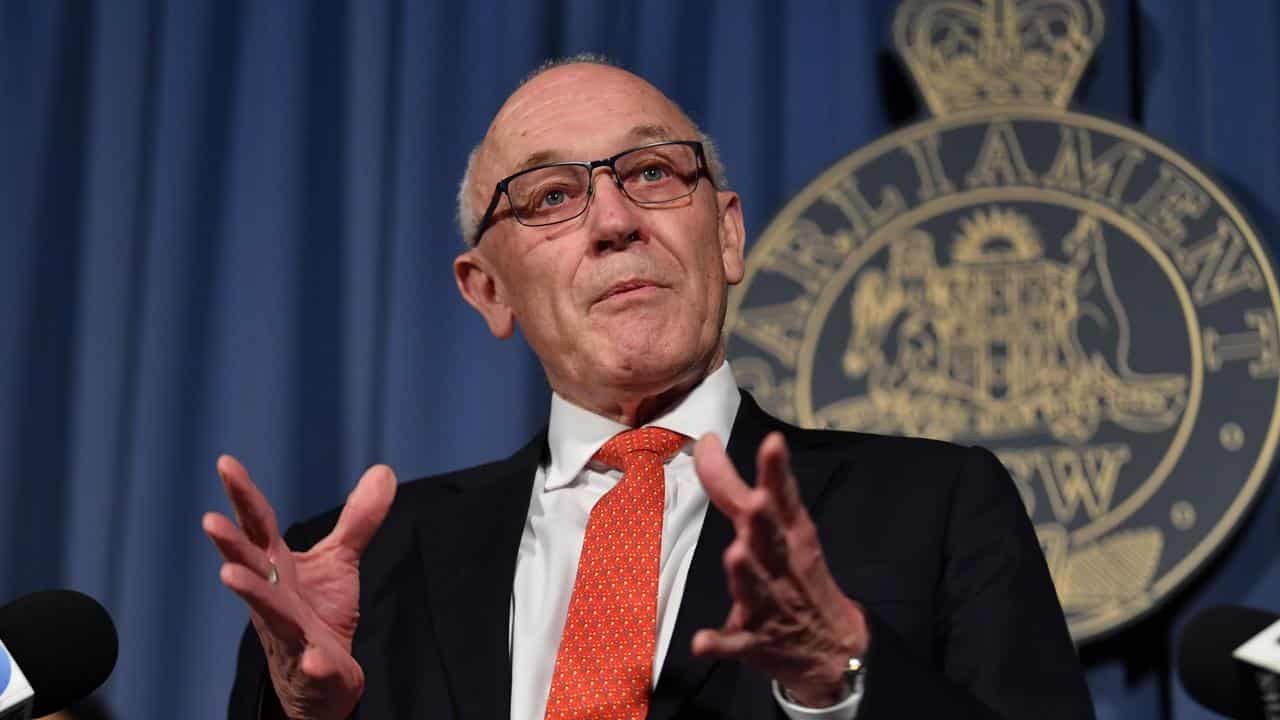

But shadow treasurer Damien Tudehope accused his Labor counterpart of relying on the GST "bogey" to cover up for the fact that record revenues were going towards public-sector pay rises.

"This is a treasurer who has continually blamed others for the problems that he has with a budget that is now out of control," he said.

The state's gross debt is forecast to hit nearly $200 billion in 2027/28, up from $156 billion in the current financial year, while net debt will continue to rise to reach nearly $140 billion.

The annual interest bill to service the debt will increase from $6.9 billion in 2024/25 to more than $8.5 billion within three years.

Borrowing costs could increase further if the state receives a downgrade from its remaining top-tier credit ratings.

Moody's Ratings, one of two agencies to give NSW debt a AAA rating, said the balance of risks to the state's financial strength was negative.

Projected annual spending growth of 2.2 per cent over the next four years would be hard to achieve because of persistent inflation and the removal of the former coalition government's wage cap, its analysts said.

Despite weaker-than-expected payroll taxes, government revenues have been revised up due to higher land taxes and stamp duty from a strong property market.

Unemployment is expected to peak at about 4.5 per cent in 2024/25, while wage growth is forecast to start outstripping inflation from the coming financial year onwards.

As part of the changes announced in the budget, the state government will consolidate seven investment pools into a single vehicle called OneFund, which is expected to deliver $1.6 billion extra in returns over the next four years.

CPA Australia described the budget as "fiscally responsible" but criticised a decision to increase land tax for many property investors and businesses.