Australia may be in the final chapters of its inflation saga but the Reserve Bank of Australia is still expected to hold off on interest rate cuts this week.

The central bank has kept the target cash rate on hold at 4.35 per cent for almost a year, a level it believes is high enough to slow the economy, weaken demand for goods and services, and bring down inflation.

All 38 experts and economists polled by Finder believe the board would keep interest rates on hold after its two-day meeting on monetary policy starting on Monday.

The majority believe cuts will begin in the first half of 2025, with 13 picking February as the start date.

Economic teams at the four big banks similarly have the first central bank meeting of 2025 pencilled in for easing to begin.

Quarterly inflation data released last week will be at the centre of discussions in the two-day meeting.

Australia’s headline inflation eased to 2.8 per cent in the September quarter, its lowest level in more than three years and back within the RBA's two-three per cent target band.

The underlying inflation rate - the trimmed mean watched closely by the central bank - came in at 3.5 per cent.

The result was down from four per cent in June, but outside the desired range.

Westpac chief economist Luci Ellis said disinflation - a slowdown in price growth - was "on track", further diminishing the chances of an interest rate hike and moving the central bank closer to a rate-cutting phase.

Yet there was nothing in recent data to imply cuts need to be expedited, she added.

"Given the uncertainties surrounding the United States election and its aftermath, we think it likely that the RBA will stand pat this time and see how global events play out," she said.

Strong job creation and low unemployment further adds to the case to stay on hold although consumer spending has been weak, in a sign interest rates are weighing on demand.

Both retail sales and household spending data from the Australian Bureau of Statistics point to sluggish spending, even as federal government tax cuts boost incomes.

AMP chief economist Shane Oliver said sticky services inflation, above-target underlying inflation and low unemployment mean the RBA is unlikely to feel an urgency to cut rates.

"But the continuing progress in getting inflation down may see it become a little less hawkish in its commentary," he said.

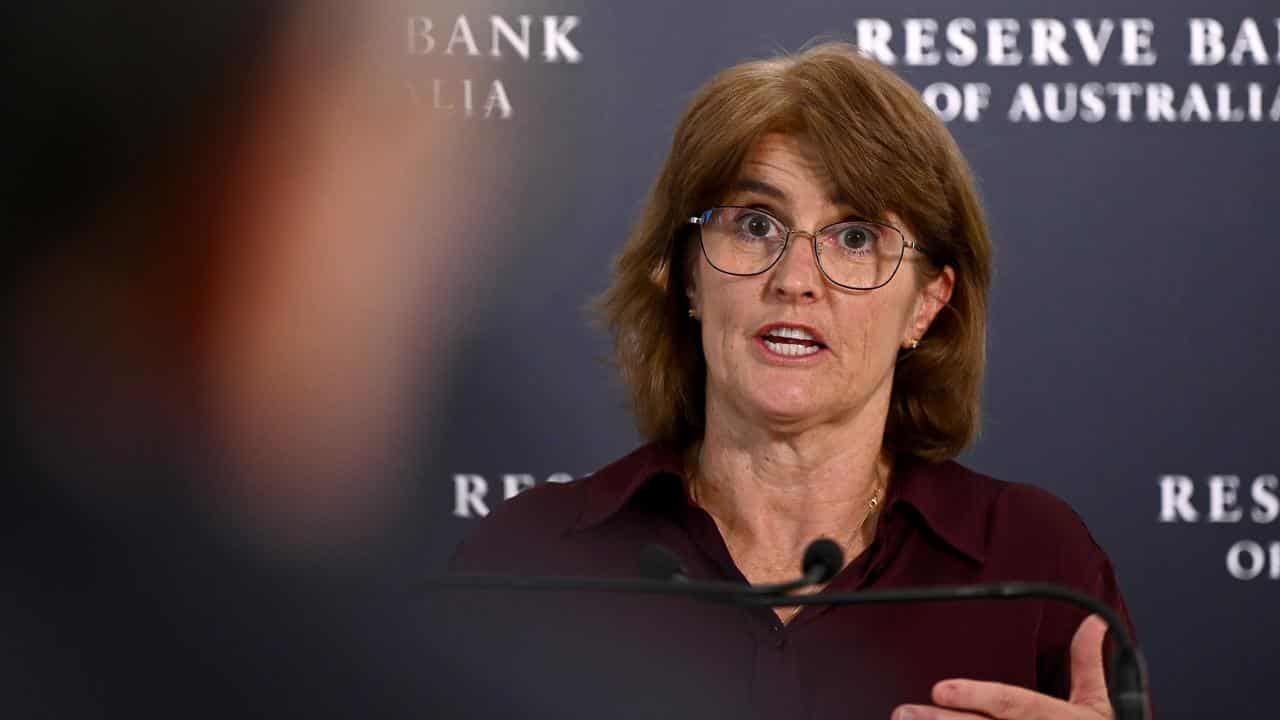

As well as a post-meeting statement from the board, RBA governor Michele Bullock will take questions from the media after the rates announcement on Tuesday.

Dr Oliver also expects a small downward revisions to inflation and growth forecast for the next year in the RBA's Statement of Monetary Policy, which will also be released on Tuesday.

Other data on the agenda include Melbourne Institute's inflation gauge, and ANZ and Indeed's job advertisement numbers due on Monday.

The Australian Bureau of Statistics will release international goods trade balance data on Thursday.

On Friday, RBA assistant governor Brad Jones will speak at the FINSIA: The Regulators event in Sydney.

Meanwhile, the Australian stock market is expected to open higher on Monday, after Wall Street jumped on Friday on the back of a strong earnings report from Amazon which countered a significant drop in US job growth in October.

The US nonfarm payrolls data showed an increase of 12,000 jobs, which was smaller than the 113,000 rise expected.

However, the unemployment rate held steady at 4.1 per cent, reassuring investors the labour market remains on solid ground and centering expectations the US central bank will cut interest rates by 25 basis points in November.

In weekend trading, the main Australia ASX SPI200 Index futures contract rose 36 points to 8170 points.

On Friday, the local bourse fell for a third straight session with the benchmark S&P/ASX200 index ending down 41.2 points, or 0.5 per cent, at 8,118.8 - its lowest close in seven weeks.

The broader All Ordinaries fell 42.4 points, or 0.5 per cent, to 8,379.7.