Higher shipping costs and other hiccups are complicating the central bank's task of lowering inflation, yet economists say a bumpy last mile was expected.

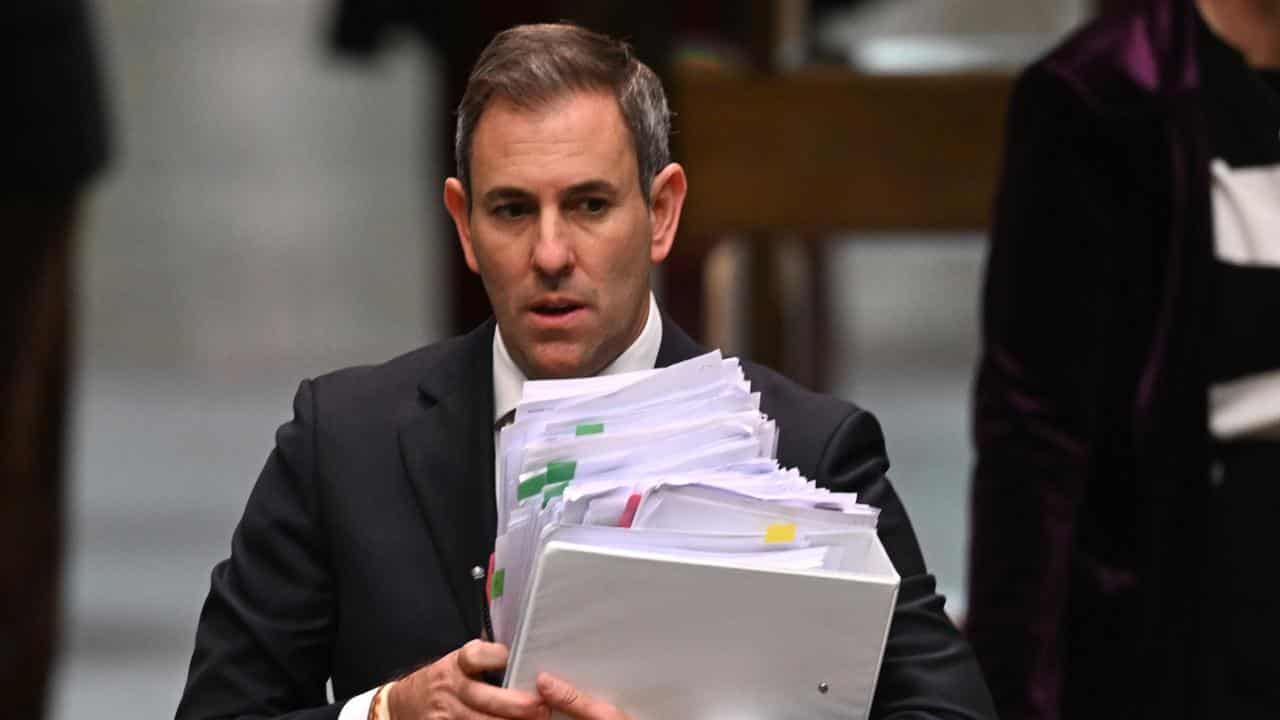

The next set of quarterly inflation numbers, which tops the Reserve Bank's watchlist ahead of its August interest rate meeting, will likely show upwards pressure from rents, insurance and petrol, the federal treasurer said on Monday.

Jim Chalmers said both domestic and international factors were in play, with the oil price up about 10 per cent since this time in 2023.

"Global freight costs have more than tripled since November and so that is a reminder of some of these pressures on inflation," he told ABC radio on Monday.

The government would consider more cost-of-living help in future budgets, Dr Chalmers said, but the immediate focus was on previously announced tax cuts and energy bill relief.

Attacks on ships in the Red Sea and drought was delaying cargo through the Panama Canal, disrupting the global shipping industry and pushing up freight costs, Westpac senior economist Justin Smirk said.

Shipping pressures were working against overproduction of goods such as electric cars in China, which was acting as a source of global disinflation.

Rising shipping costs would still "shift the dial from being a disinflationary story to a neutral, possibly slightly inflationary story in terms of imports", Mr Smirk said.

A hotter-than-expected monthly inflation print for May sparked speculation interest rates may need to stay higher for longer, and upped the chance of another hike in August.

Much is riding on the more comprehensive quarterly dataset due out later in July.

The chance of another interest rate hike was "incredibly slim", Mr Smirk told AAP.

The bank is pencilling in a November start to cuts and expects June quarter inflation in line with the RBA's own forecasts, rising 3.8 per cent annually in the year to June.

Domestic wage growth had already peaked, with Mr Smirk pointing to softer-than-expected price growth for household services such as takeaway food and hairdressing.

Yet insurance and rents remain an ongoing problem, he said, although the latter was expected to moderate as vacancy rates kept ticking higher from extremely low levels.

ANZ expect inflation to come in a little higher than the RBA's forecast in the June quarter, with its economic team tipping a 3.9 per cent annual rise for both the headline and trimmed mean.

But no hike is expected in August, with ANZ's senior economist Catherine Birch suggesting Australia was experiencing a similar bumpy path to tame inflation as other major countries .

Reflecting on softer-than-expected consumer price numbers out of the United States, Ms Birch said Australia had been following the same pattern, but with a lag.

"What's interesting is that we saw inflation pressures sort of pick up a bit in the US early this year, and then started to ease again in the June quarter," she told AAP.

"Australia might just be behind the eight ball a little bit, and that's why we're seeing a bit of a pick-up in inflation pressures at the moment," she said.