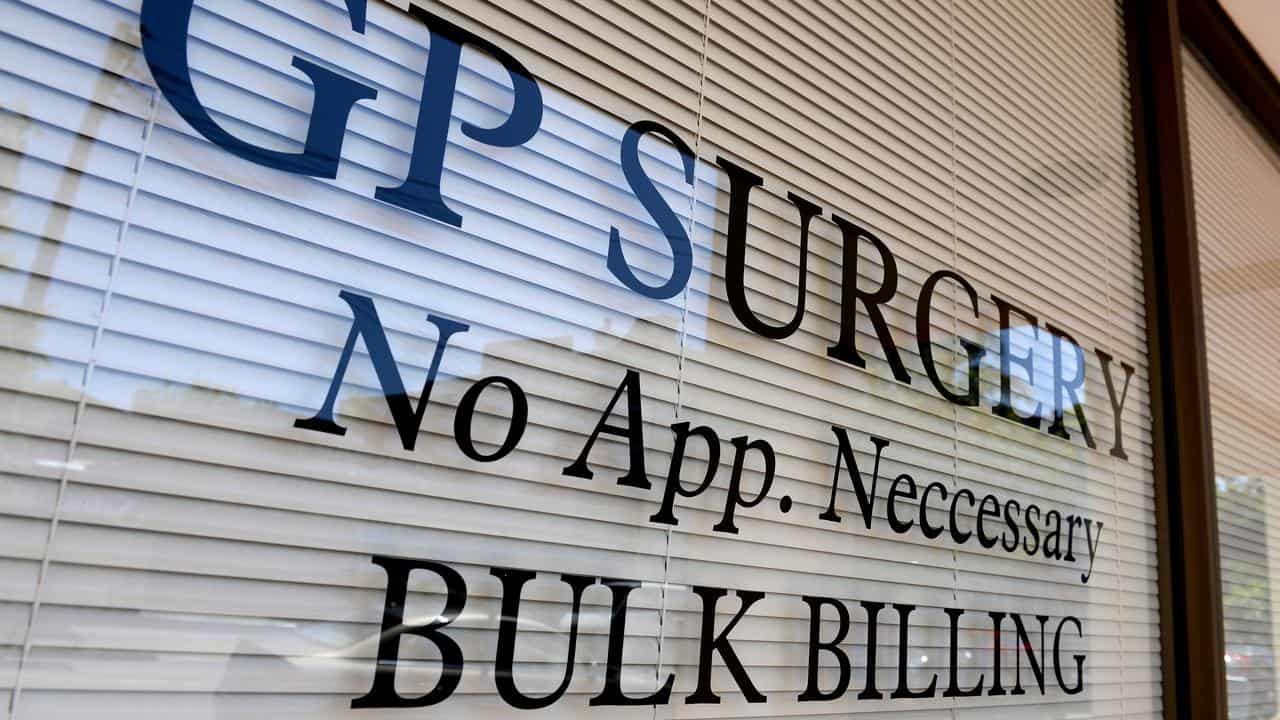

A tax-relief incentive for GPs who bulk-bill has been designed to put a floor under declining rates of doctors seeing patients without charging out-of-pocket costs, NSW officials say.

But prices are likely to go up for people in areas where bulk-billing doctors are few and far between as GPs pass the extra tax impost to their clients.

The initiative, billed by the Minns Labor government as one of its key cost-of-living measures in its second budget, could save bulk-billed patients as much as $20 a visit in costs that would otherwise have been passed on.

Medical centres that bulk-bill above certain thresholds will get full payroll rebates for work done by contractor GPs as part of a $189 million scheme.

Sydney practices that bulk-bill more than 80 per cent of patients and regional centres that bulk-bill at least 70 per cent will be eligible.

The government has also waived unpaid payroll tax liabilities until early September, ending a long stand-off with peak doctors' bodies over the impending charge.

The Royal Australian College of General Practitioners and the Australian Medical Association back the changes while arguing that current Medicare rebates do not cover the costs of running a small business.

Health Minister Ryan Park said on Thursday the state government was trying to ensure there was no "slippage" in healthcare services at medical centres in the coming years until there was better federal support for GPs through Medicare.

"This is to make sure we hold what we've got right now," he said.

"What I couldn't afford to see - was starting to see - a reduction in bulk-billing across the community in the middle of a cost-of-living crisis."

Medicare data shows primary health networks covering Sydney's west and southwest, and the Nepean-Blue Mountains region broadly, meet the metropolitan bulk-billing threshold.

The Hunter-New England and Central Coast, south-eastern NSW, western NSW, Murrumbidgee and north coast networks are above the regional threshold.

But in areas below the required marks - which include central, northern and south-eastern Sydney - many patients should expect a price hike after September.

“If (medical centres) are over the $1.2 million threshold for payroll tax and are required to pay payroll tax, yes, prices will go up,” RACGP chair Rebekah Hoffman said.

One of the key measures in the budget announcement was providing an amnesty for past liabilities, ensuring that practices did not need to foot the bill for five years of taxes, she said.

Opposition Leader Mark Speakman welcomed the waiving of the payroll tax obligations but gave the government no credit for cost-of-living relief as the charge had never been collected before.

Australia's bulk-billing rate had slipped to 75.6 per cent in October 2023, but it has lifted back up to 79 per cent in May.

NSW's overall rate also increased in that time period to 83.3 per cent.

Federal Health Minister Mark Butler said increasing bulk-billing incentives were a "game-changer" for Medicare.