Australia has been urged to boost fuel security without compromising food supplies or adding to the world's carbon footprint.

Heated debate over land use was becoming "less emotional and more logical" as demand for alternative fuels was strong, GrainCorp head of agri-energy Jeff Summerville told an industry conference on Wednesday.

Rival economies in Europe and North America, supported by tax breaks and carbon markets, are ahead in the race for crops to be turned into green diesel and sustainable aviation fuel.

"We see a great chance for our farmers to have a new demand source, and it gives farmers and farming communities the ability to diversify," Mr Summerville said.

"We are a land of droughts and flooding rains and therefore we have to be really efficient at what we do."

Crops for fuel could be grown in more marginal areas, bringing land that was being used back into production rather than reducing prime agricultural land or resorting to land-clearing, he said.

Industry leaders at Australian Renewable Fuels Week in Canberra urged federal and state governments to support local biofuel production and send stronger signals to farmers to grow more of the feedstocks the world was asking for.

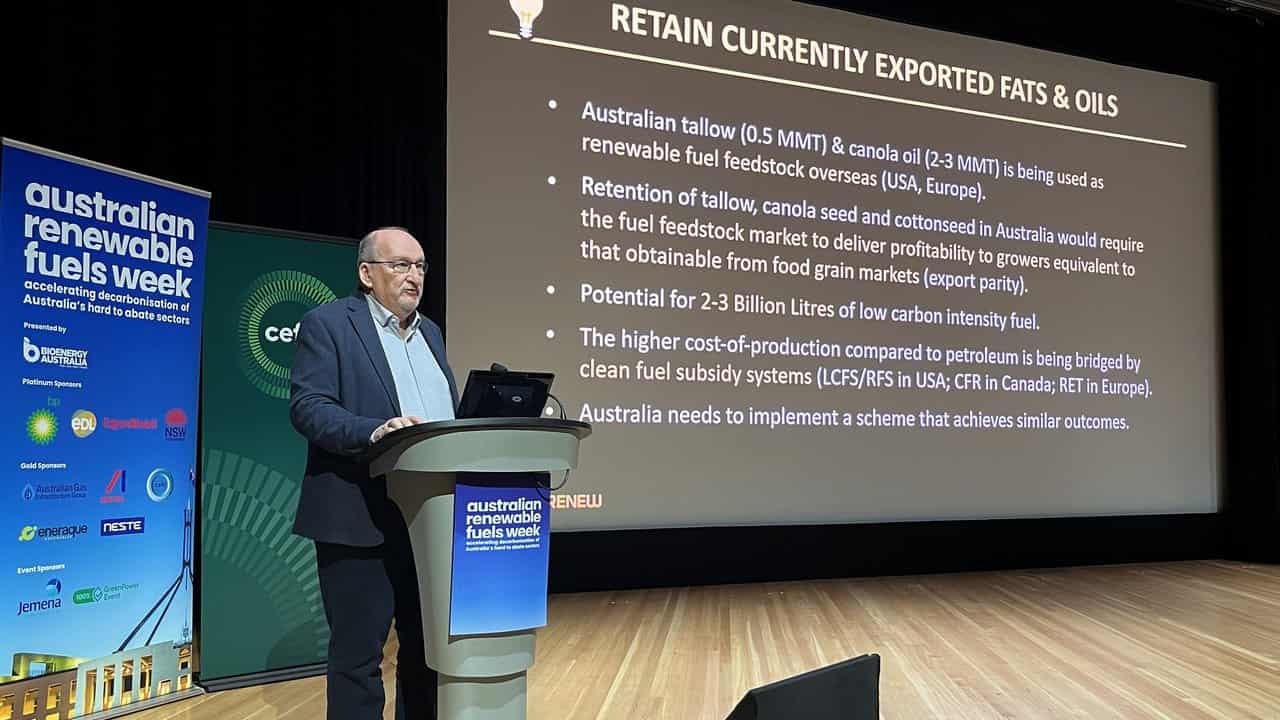

In the United States, Canada and Europe, the cost of production compared to petroleum is being bridged by clean fuel subsidies and carbon markets, and generous fossil fuel subsidies are beginning to be phased out.

Leading Australian scientist Allan Green said canola and other plant-based biofuel sources should be processed onshore instead of becoming green fuel feedstock overseas.

Dr Green said Australia needed to intensify production where possible and could do that without affecting the nation's food supply.

"We now have a national fuel security imperative, we have an emissions imperative - I think we have to start to think about our sustainability goals," he said.

Global food security might be a top priority but Australia only produced two per cent of global grain, even though it exported two-thirds of national grain production, he said.

The US and Canada were retaining canola and soybeans to start their renewable fuel industry, Dr Green said.

"We'll have to be open for the discussion around a social licence to do that in Australia because otherwise we'll be limited in how far we can go," he said.

Nuseed general manager Rachel Palumbo said Australia needed a better understanding of the role farmers could play.

Australia was already a key feedstock provider and well-established producer of food, feed, fibre, and fuel for domestic and international markets, she said.

But CSIRO's Max Temminghoff warned other countries "that don't necessarily have Australia's best interests at heart" were starting to purchase farmland here to grow sustainable aviation fuel crops for production and use elsewhere.

"We're looking at developing an assessment tool that can help us understand Australia's bio resources," he said.

Meanwhile, Australia’s first biomethane-to-gas-network injection plant has been certified under a government-managed program called GreenPower.

The Malabar plant, a partnership between Sydney Water and energy infrastructure company Jemena, will supply Origin Energy up to 110 terajoules of biomethane per year.

"Certification is the next step in establishing a domestic renewable gas market," Jemena boss David Gillespie said.

Jemena has also signed a pact with producer Optimal Renewable Gas to identify sites in regional NSW that could produce up to 1.5 petajoules for injection into the state's gas network.