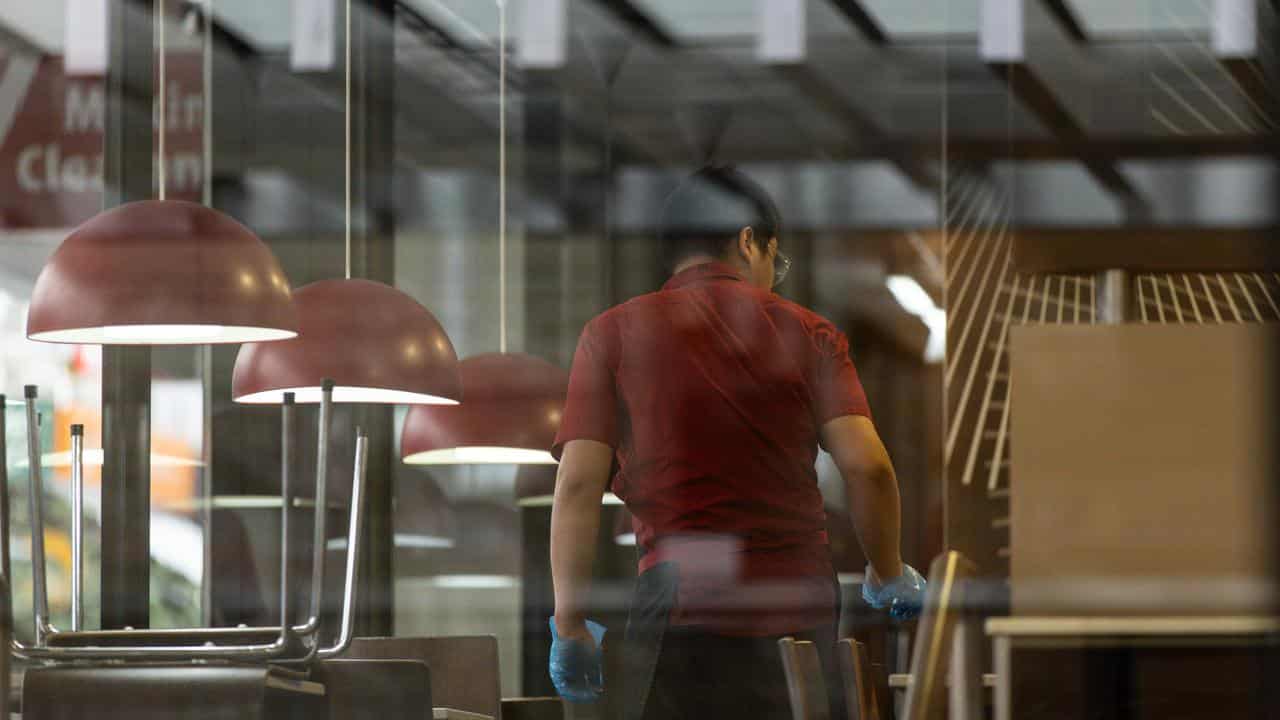

Pubs, restaurants and cafes reaped the benefits of early Father's Day celebrations but the boost was likely temporary as financial pressures keep a lid on consumer spending.

Hospitality spending jumped 5.2 per cent in August, based on Commonwealth Bank transaction data.

The bank chalked that up to dads being treated to meals out, with money also funnelled into hardware stores and men's clothing outlets as adult children picked up gifts.

Australian Restaurant & Cafe Association chief executive officer Wes Lambert agreed the spending increase was probably a blip and weak consumer demand would likely return.

Rising prices and larger mortgage repayments have taken a toll on household budgets and kept spending contained.

Spending at hospitality venues had been trending weak, with Australian Bureau of Statistics retail sales figures virtually flat for cafes, restaurants and takeaway food services in July.

Mr Lambert said hospitality venues still faced a "perfect storm" of weak consumer demand and higher costs of doing business, especially for rent, utilities, insurance and labour.

"Many are unable to lift menu prices to cover costs due to soft consumer demand," he told AAP.

Deteriorating conditions for consumers and outlets have left one in 11 hospitality businesses facing failure, credit reporting bureau CreditorWatch predicted in July.

Mr Lambert expected conditions for hospitality would be tough for the rest of 2024 and would "hopefully" improve in 2025 as inflation moderated and interest rate cuts began.

CBA chief economist Stephen Halmarick also expects spending and the broader economy to remain weak.

The bank forecasts the RBA to cut interest rates later in 2024, a departure from the remaining three big banks tipping a 2025 start.

CBA expects inflation to moderate faster and the labour market to loosen more than the central bank thinks, hence the predicted earlier start to cuts.

"However, there is a possibility of delays pushing this into early 2025,” Mr Halmarick said.

Thursday's spending indicator also captured the early impacts of government power bill rebates, with utilities expenditure down 0.3 per cent.

"This, coupled with increased education spend, impacted spending across home ownership categories as we saw a jump in spending by renters likely due to university fees, while outright owners benefited from reduced spend on utilities as this is typically a larger share of their wallet,” Mr Halmarick said.