Carrying a physical bank card to get cash out of an ATM is old news, digital wallets are in.

Research from the Australian Banking Association shows cash is no longer king, with an unprecedented number of people using their digital wallet.

The 2024 Bank On It report shows digital wallet use has increased 18-fold over the past five years, but for the first time has overtaken ATM cash withdrawals.

Digital wallet use accounted for $126 billion in payments in the past year, compared to $105 billion in ATM withdrawals.

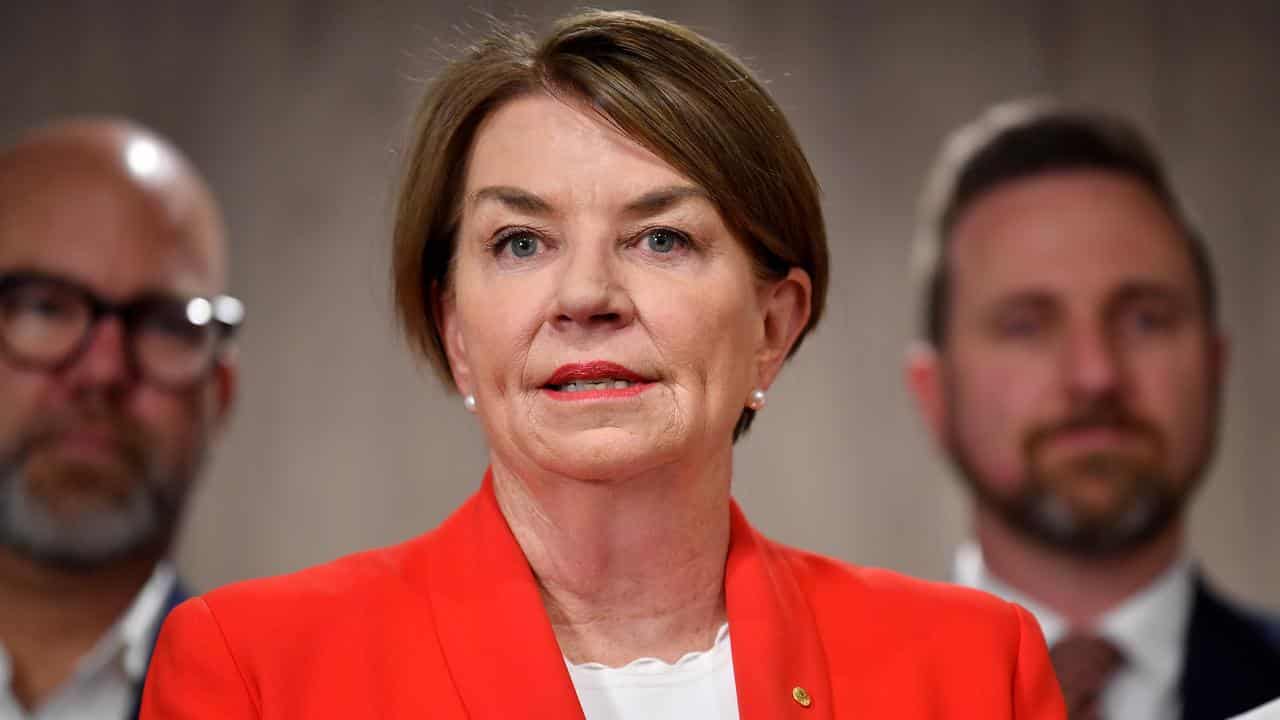

“Australians are going digital in all aspects of their lives and banking is no exception," ABA chief executive Anna Bligh said on Thursday.

“We are in the midst of a digital banking boom in this country."

The decline in cash has been recorded across ages and geographic locations.

The starkest change is among the 65-year-old and older age group, which has reported a 69 per cent drop in cash usage since 2007.

Traditionally, regional and remote residents chose to use cash but over the past decade have recorded an 80 per cent shift to digital payments.

It also does not matter the size of the payment, with most Australians resorting to digital methods.

In 2007, payments up to $10 were primarily made by cash, but now just 20 per cent of smaller payments are made with physical currency.

Ms Bligh warned the surge in digital wallet use needed the same scrutiny and consumer protections as other payment methods.

“That’s why the ABA supports upcoming legislation to ensure Australia’s payments regulatory framework remains fit-for-purpose and covers new entrants into the market," she said.

For Australians worried that cash is being phased out, Ms Bligh soothed concerns by confirming banks will continue to offer physical tender and face-to-face options despite the online trend.

“This report shows that Australians are using less and less cash, but we’re not about to become cashless anytime soon,” Ms Bligh said.