Australia's biggest bank was less profitable in the first half, with its operating expenses increasing while its income stayed flat amid increasing competition for home loan customers.

Commonwealth Bank made $5.02 billion in cash profit after tax in the six months to December 31, down three per cent from the first half of 2022/23.

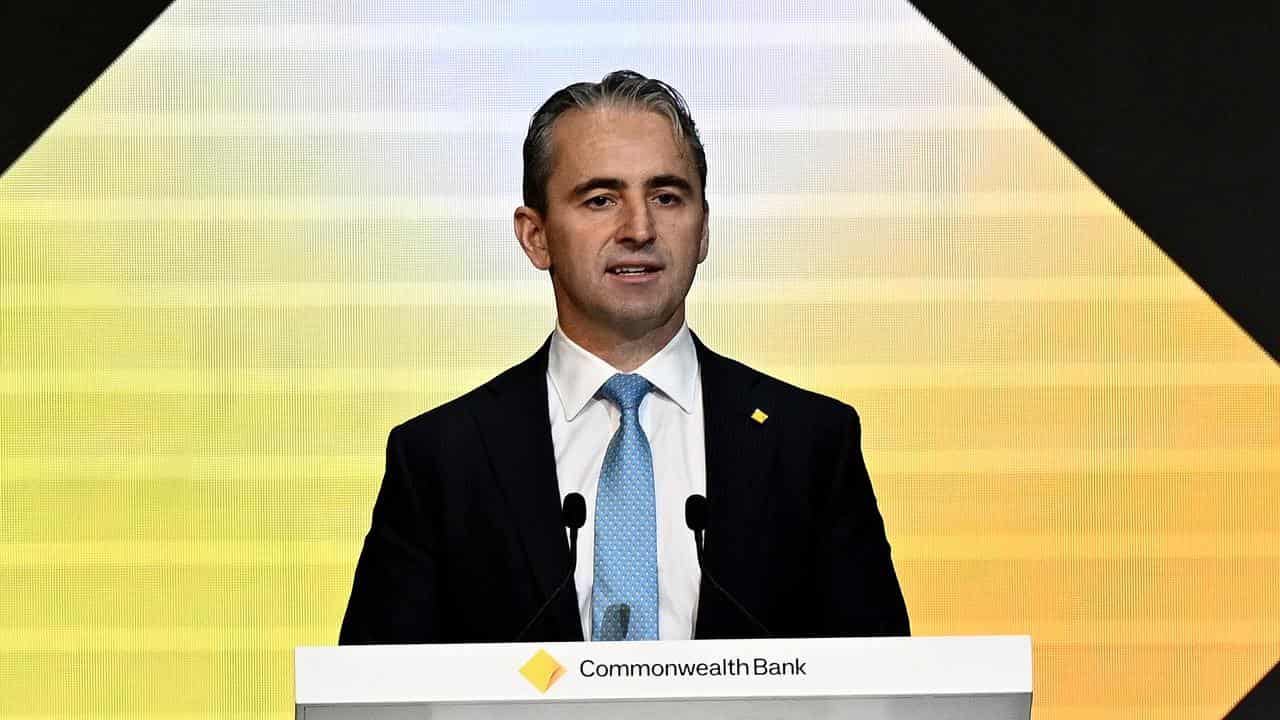

"Our lower cash profit reflects cost inflation and a competitive operating environment," CBA chief executive Matt Comyn told shareholders on Wednesday.

The bank's net interest margin, a key measure of profitability, dropped 11 basis points to 1.99 per cent, as customers switched to higher yielding deposits, wholesale funding costs increased and CBA's New Zealand subsidiary ASB delivered a smaller contribution.

Operating expenses were up 4.1 per cent to $6 billion due to inflation and additional spending on technology, while loan impairment expenses dipped by $96 million to $415 million.

Commonwealth Bank said its customer arrears in mortgages and credit cards ticked up but remain at historically low levels.

Just 0.52 per cent of customers were more than 90 days behind on their mortgage payments as of December, compared with the historical average of 0.65 per cent.

Mr Comyn told analysts that CBA, seen as the least aggressive of the major banks on mortgage pricing, had moved closer to the market to retain market share.

"Clearly it's been a very price sensitive and competitive market, which you expect in a very high refinance market," he said.

"From our perspective, it's been a challenging last calendar year for these sorts of things."

CBA has found that the customers refinancing a mortgage tend to have more risk characteristics than other borrowers, Mr Comyn said.

The bank is focused most on trying to compete on mortgages for investors, rather than owner-occupiers, which have higher margins, as well as loans to new purchasers rather than customers refinancing an existing mortgage.

"As you can see, tactically and where we're choosing to compete, there's deliberate choices," he told analysts.

"We look very carefully at the risk characters, through channel, the pricing, the return profile."

CBA's Tier One capital ratio stood at 12.3 per cent at year end, up from 12.2 per cent six months ago and well above regulatory requirements.

"Our balance sheet remains strong with high levels of provision coverage, surplus capital and conservative funding metrics," Mr Comyn said.

He said 35 per cent of Australians and more than 26 per cent of businesses now considered Commonwealth Bank to be their main financial institution.

Chief financial officer Alan Docherty said CBA had added 650,000 new retail transaction accounts in the past 12 months, half of which were to migrants.

"We've had historically and we've seen that again over the past 12 months, a very strong market share of those new migrant account openings in Australia, and obviously because of the record level of migration, that's provided real franchise improvement and momentum within the retail bank," Mr Docherty said.

CBA announced an interim dividend of $2.15 a share fully franked, up from a $2.10 a share a year ago.

Saxo Asia Pacific senior sales trader Junvum Kim said the sub-two per cent margin raised concerns about lacklustre consumer sentiment amid sticky inflation, as well as heightened competition.

But despite CBA's cautious outlook, the higher dividend payout was seen as attractive, Mr Kim said.

Late on Wednesday afternoon CBA shares were down 1.9 per cent to $113.84, on a down day for the market.