A Victorian rent cap could be considered as the government fends off concerns its state budget will compound housing market headaches.

Roughly 860,000 Victorian investment, holiday home or business property owners are set to be slugged $4.7 billion over the next four years under a COVID-19 debt levy announced in Tuesday's budget.

From January, property investors will pay a fixed $500 fee each year for landholdings worth between $50,000 to $100,000, $975 if above $100,000 and an extra 0.1 per cent for every dollar above $300,000.

It will mean investors pay $1300 a year on average in extra tax.

Real Estate Institute of Victoria chief executive Quentin Kilian says the changes will force landlords to leave the sector, diminishing rental supply and fuelling cost pressures.

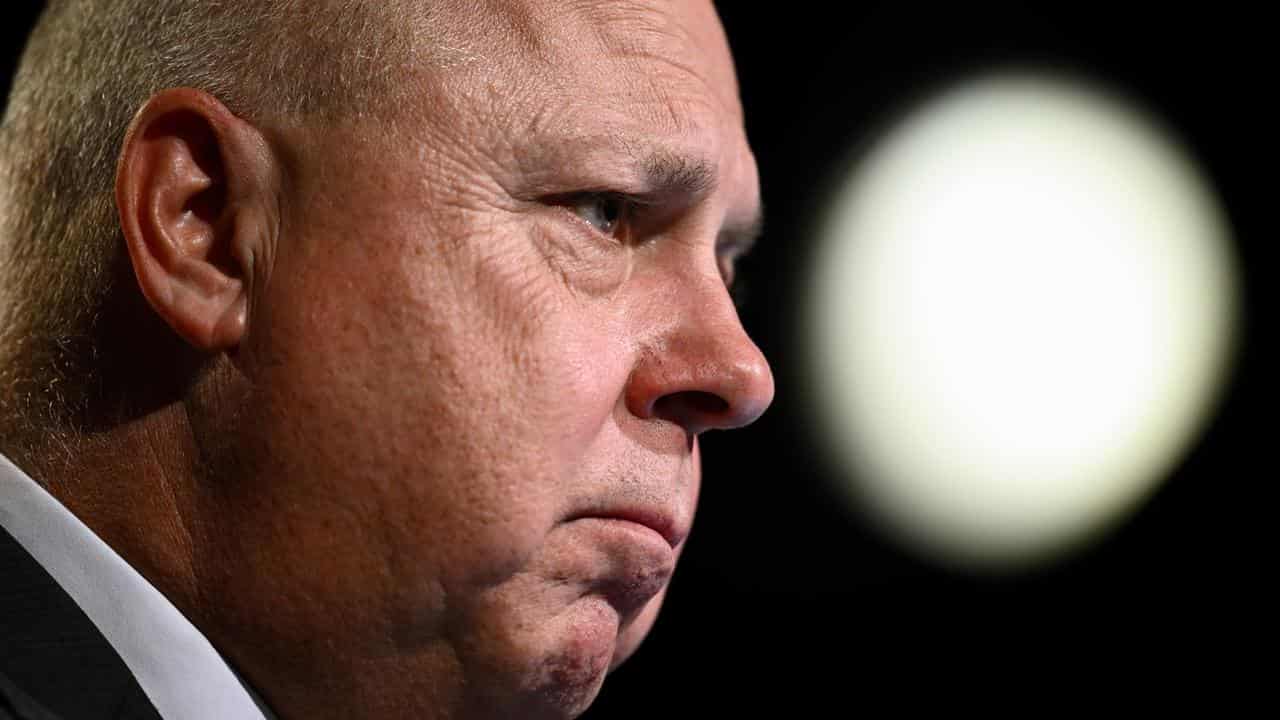

In his first public appearance since handing down his ninth budget, Treasurer Tim Pallas ruled out an outright rent freeze to curtail a 25 per cent rise in Melbourne rents over the past five years.

But he flagged the Andrews government would look at a rental cap or another form of market intervention to ease the pain for the one in three Victorians who are tenants.

"There has to be a point at which the community says this has gone beyond reason," he told a post-budget Victorian Chamber of Commerce and Industry lunch on Wednesday.

"I'm not suggesting that we won't intervene in the way the housing market operates ... it's a question of what interventions are the most appropriate."

Premier Daniel Andrews blamed a lack of housing supply rather than land tax for driving up rents.

"Anybody who is applying for a rental and finds that they're one of 25 different applications or 50 even ... they can tell you there’s not enough supply," he said.

"That's why we need to make better decisions and make them faster."

His government will hand down a housing and planning strategy statement in September to address the lack of available homes.

Mr Andrews noted land tax is deductible for some landlords under the federal tax system and denied the budget would punish ordinary Victorians.

Along with the changes to land tax, Victorian businesses with national payrolls above $10 million - or five per cent of the state's employers - will pay an additional 0.5 per cent in payroll tax from July 1.

Businesses with a national payroll above $100m will also pay one per cent in additional tax, with the move expected to raise $3.9b over the forward estimates.

About 110 high-fee private schools will be stripped of their longstanding payroll tax exemption and up to 4000 public sector worker jobs are set to go.

Business groups have lined up to condemn the measures designed to stabilise net debt, which is projected to hit $171.4b by mid-2027.

Chamber chief executive Paul Guerra said property owners and medium and large businesses were being used as an ATM to pay off the debt, warning it will directly impact jobs and investment.

"At best it's a tough budget for business," he said.

Mr Andrews maintained the changes were necessary to drive down debt incurred during the COVID-19 pandemic.

Opposition Leader John Pesutto said the government could reduce debt by cutting infrastructure spending waste instead of targeting businesses, schools and mum and dad investors.

"Victorians are being punished for the incompetence of the Labor government," he said.

The Victorian Parliament is set to launch an investigation into the state’s rental crisis.

A senate committee voted to self-refer the inquiry, which will investigate housing affordability and systemic issues.