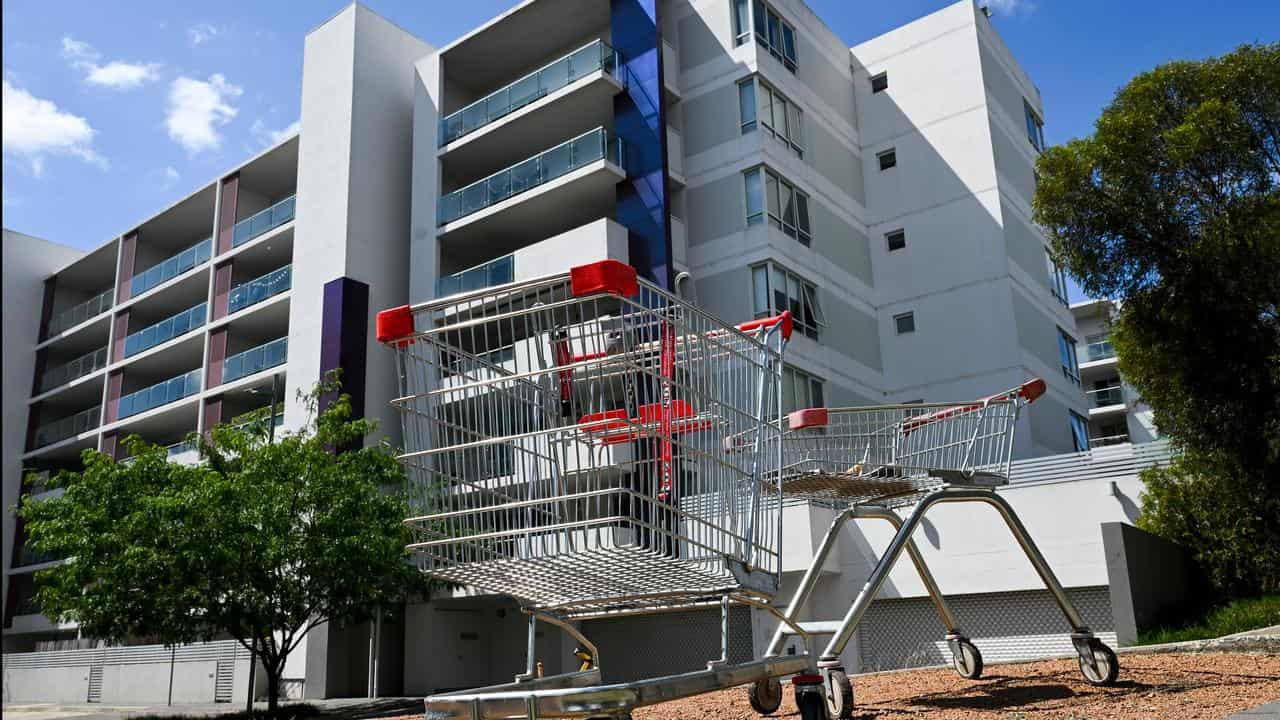

Another route into home ownership could soon be blocked off for some Australians as the construction industry battles insolvencies, rising material costs and workforce shortages.

Buying "off the plan" involves purchasing a property that has not been built yet or is still under construction, and was once considered a more accessible avenue into home ownership as many first-time buyers can qualify for grants or stamp duty concessions.

There could soon be more options to buy this way as state and federal governments commit to building millions of new homes over the next three decades in an attempt to tackle the housing crisis.

However, buying off the plan may have become more risky, according to Compare the Market's property expert Andrew Winter.

Figures from the Australian Bureau of Statistics show 73,405 construction businesses ceased their operations in the 12 months to June 2023 amid supply chain issues and labour shortfalls.

"If the builder goes broke, you may lose your deposit," Mr Winter said.

Sunset clauses can also allow builders to refund a homebuyer's deposit and terminate the contract if the building is not completed by a certain date.

Though some states have changed laws in a bid to protect off-the-plan buyers, units are not included.

"There’s also a chance the final build may not meet your expectations, as you have not actually inspected the property you are buying based on the plans and specifications provided by the developer," Mr Winter said.

Master Builders Australia chief executive Denita Wawn, whose organisation represents the building and construction industry nationally, says there is some optimism within the sector.

"Master Builders and its members have been working closely with other industry participants to ensure there are builders and tradies available to pick up projects in the instance of insolvencies," she told AAP.

"The good news is there are more businesses entering the industry than going insolvent, so it’s not all doom and gloom."

However, homebuyers must still exercise due diligence, she warned.

"Ensure the developer and builder have all the right checks and balances in place including insurance, the contract is fit for purpose, and you have an appropriate buffer for any unexpected events or delays," Ms Wawn said.

Mr Winter also recommended Australians check their builders' completed projects to ensure they know what they are buying into.