Untouched by politicians of all stripes in 25 years, genuine tax reform in Australia has gone the way of the Tasmanian Tiger.

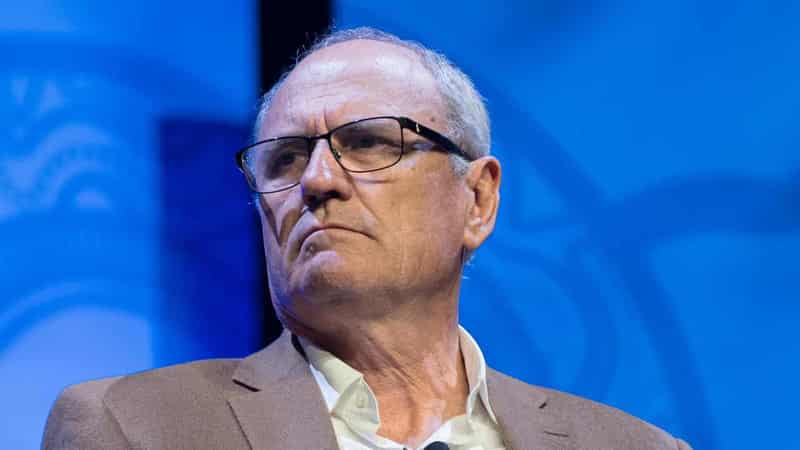

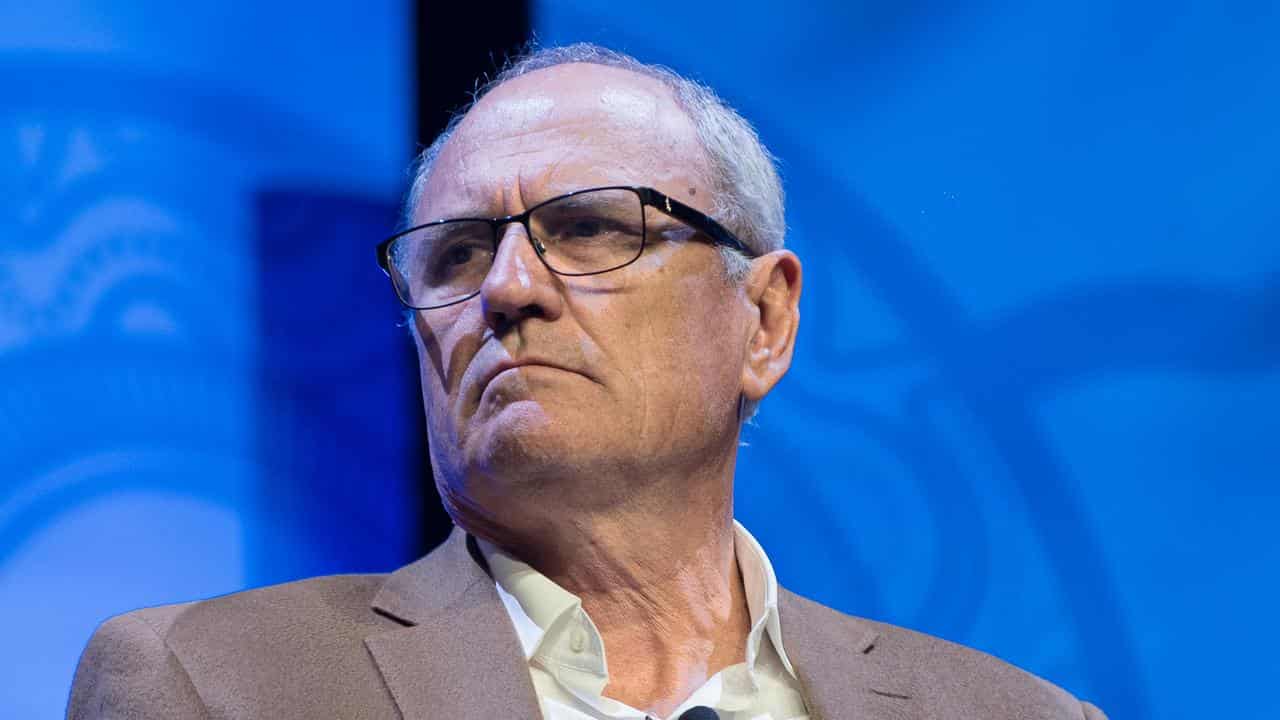

Ken Henry knows this more than most.

Now chair of conservation group the Australian Climate and Biodiversity Foundation, Dr Henry wrote the book reshaping the nation's tax system when he was treasury secretary in 2010.

To his dismay, the report has been left to wither while the unfit-for-purpose tax system has continued to exacerbate inequities and inefficiencies in Australian society.

Dr Henry hopes a new push can bring tax reform back from the brink of extinction after no sightings since the GST in 1999.

"Tax reform has been on the policy agenda in Australia for as long as I've been alive, but mostly, politicians have retreated from engaging with the hard issues," he said.

Through short-term thinking and a dearth of effective leadership, politicians have failed to convince the community that hard decisions are needed to bring about difficult change.

Independent MP Allegra Spender has attempted to address this with a green paper that seeks to bring back genuine discussion about reducing the burden on income earners, promoting home ownership and incentivising innovation and productivity growth.

The need has never been more urgent, she argued, with the tax burden falling increasingly on young working people and the Australian dream of owning a home growing out of reach.

"Political wedging and short-termism has meant that we have a tax system that is no longer fit for purpose," Ms Spender told reporters on Thursday.

"It is failing us and we need to step forward."

The paper does not detail any specific changes but Ms Spender already has a few in her sights, including abolishing stamp duty in place of land tax and replacing the petrol excise as electric vehicles become the norm.

These suggestions would be familiar to those with a long-term interest in tax policy, given they were proposed in Dr Henry's review more than a decade ago.

"We need new energy. We need a new approach," he said.

While it's tempting to blame politicians for lacking fiscal spines, the media is equally at fault.

"There was a time in the past when the media sought to play a constructive role in building the nation and I'd like to see the media go back to that," Dr Henry said.

"Nothing difficult gets accomplished without a strong, compelling narrative, without political leadership that brings the community along.

"This green paper is a step to building that narrative."

Ms Spender says she has received positive feedback from the major parties but an expanded crossbench can be a driver of change, especially if there is a hung parliament after the next election.

"The crossbench has the opportunity to ... lift the debate so that we can have a mature, sensible debate about the long-term, about the future, about creating a country that our children will want to live in," fellow independent Kate Chaney said.

"It's a hard discussion and we will see it turned into political point-scoring again but we actually need to be brave."