The Austrlian share market has finished little changed, consolidating after underwhelming economic data from China and following its strongest weekly gains of the year.

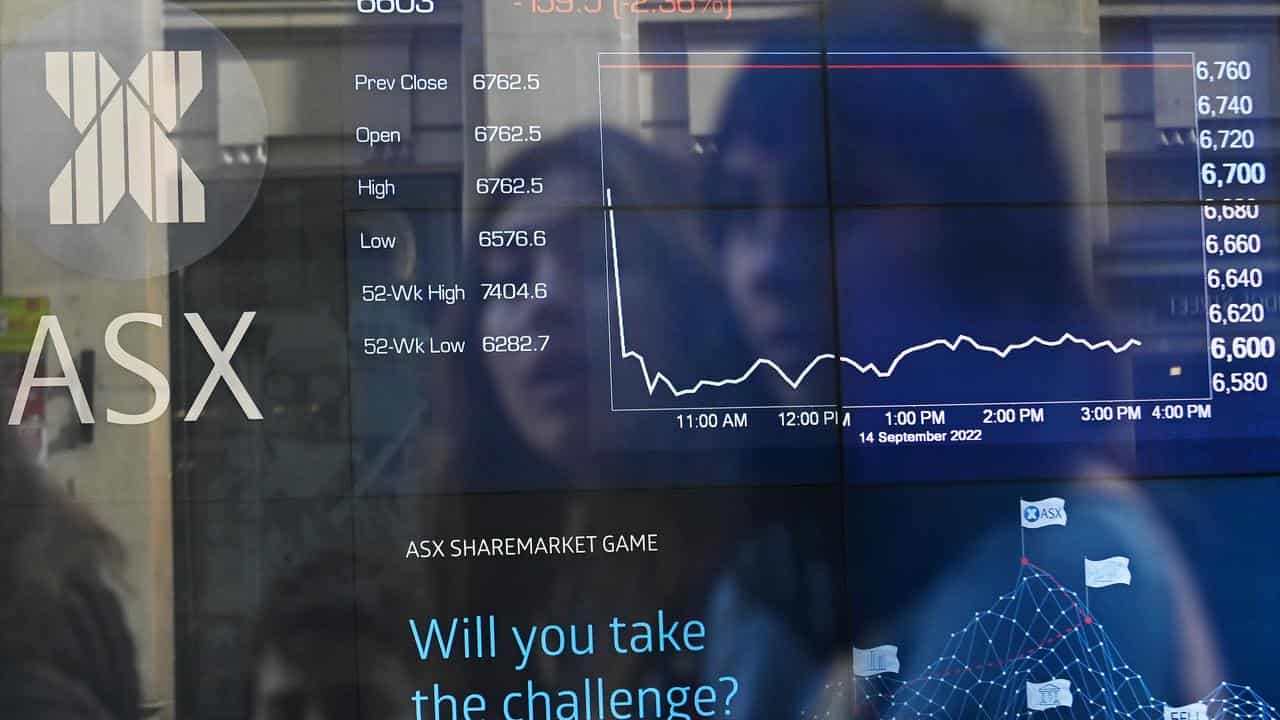

The benchmark S&P/ASX200 index on Monday finished 4.6 points lower at 7,298.5, while the broader All Ordinaries dropped 5.5 points, or 0.07 per cent, at 7,511.6.

"Market sentiment is pretty much negative among traders and investors due to the Chinese economic data, which missed the forecast and raised concerns that the second-biggest economy in the world is suffering from a crisis," said Naeem Aslam, chief investment officer of Zaye Capital Markets.

Traders and investors had been highly focused on the GDP print, hoping for a decent reading if not a strong one, Mr Aslam said.

But Beijing's National Bureau of Statistics reported on Monday that the world's second-biggest economy grew by 6.3 per cent in the year until June 30, missing expectations of a 7.1 per cent rise.

The slight loss broke a four-day winning streak that resulted in a 3.7 per cent lift in the market last week.

Alcohol retailer Endeavour Group was the biggest loser among the ASX200 on Monday, plunging 9.9 per cent to $5.62 after the Victorian government over the weekend announced reforms regarding poker machines.

Endeavour Group said there was a great deal of detail to work through regarding the changes and it was difficult to speculate on their impact.

It appeared the reforms in Victoria would be similar to measures in place in other states that the company was working to implement, it said.

Endeavour Group is Australia's largest pub owner, with some 350 hotels across the country.

The heavyweight mining sector fell 0.8 per cent on the weak China data, with BHP dropping 0.6 per cent to $45.26, Fortescue dropping 1.3 per cent to $22.49 and Rio Tinto 1.0 per cent lower at $117.85

The big four banks mostly finished higher, with NAB up 0.7 per cent to $27.12, CBA adding 0.5 per cent to $101.87 and ANZ growing 0.4 per cent to $24.54.

Westpac was the outlier, edging .01 per cent lower to $21.43.

Whitehaven Coal finished 2.7 per cent higher at $6.83 after the coalminer said its 2022/23 production, sales and unit costs had been within guidance, except at its Narrabri mine in NSW which had produced slightly below forecasts.

The Australian dollar was buying 68.04 US cents, down from 68.86 US cents at Friday's ASX close.

Looking forward, this week the UK, Canada and Japan will report inflation data, and Mr Aslam said traders were expecting a "massive" readout from the UK.

Closer to home, the Reserve Bank of Australia on Tuesday will release minutes from its July 5 board meeting, where it left the cash rate unchanged at 4.1 per cent.

On Thursday, the Australian Bureau of Statistics will announce June labour force data.

ON THE ASX:

* The S&P/ASX200 index finished Monday down 4.6 points, or 0.06 per cent, at 7,298.5.

* The All Ordinaries dropped 5.5 points, or 0.07 per cent, to 7,511.6.

CURRENCY SNAPSHOT:

One Australian dollar buys:

* 68.09 US cents, from 68.86 US cents at Friday's ASX close

* 94.26 Japanese yen, from 94.92 Japanese yen

* 60.60 Euro cents, from 61.34 Euro cents

* 52.05 British pence, from 52.48 pence

* 107.31 NZ cents, from 107.66 NZ cents.