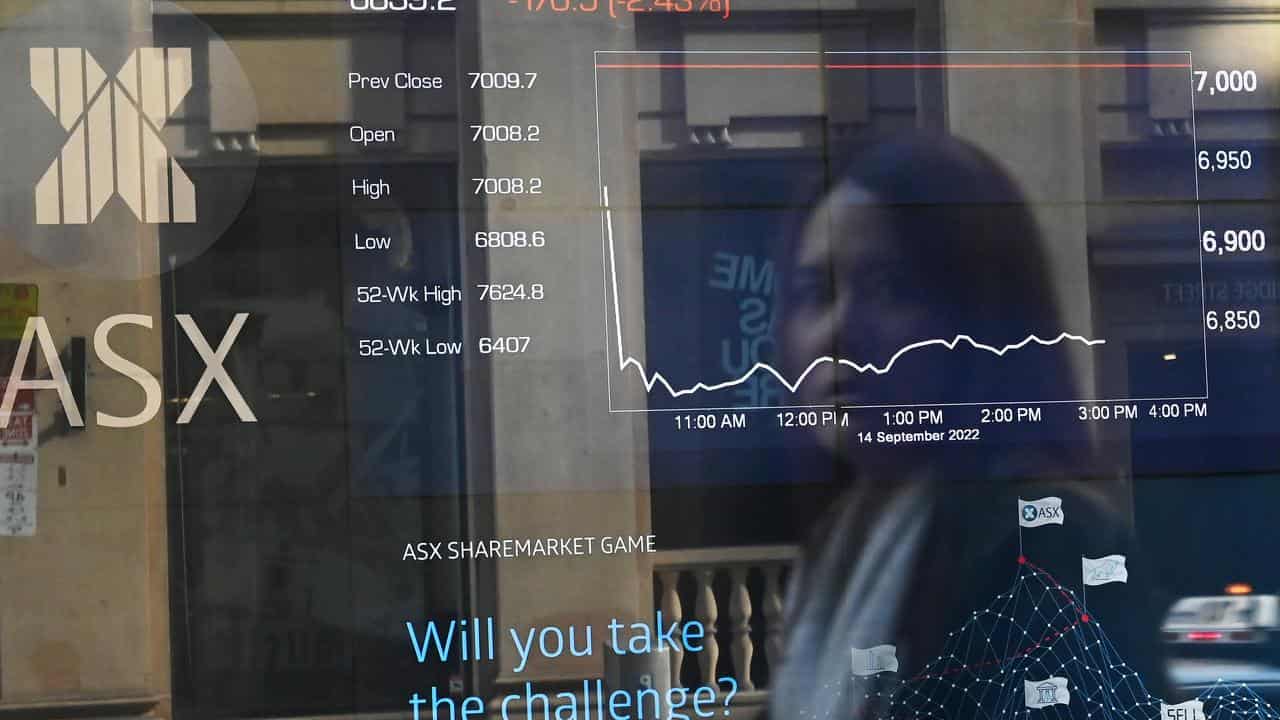

The Australian share market has fallen sharply in its worst day of losses for two weeks, weighed down by a tumbling iron ore price.

The benchmark S&P/ASX200 index on Wednesday finished down 89.8 points, or 1.24 per cent, to 7,163.4, while the broader All Ordinaries fell 88.1 points, or 1.18 per cent, to 7,365.

The local bourse shrunk after a negative lead from Wall Street, with the S&P 500 and Nasdaq falling 0.2 per cent after US Federal Reserve minutes flagged future interest rate increases.

While all policymakers thought it was "appropriate or acceptable" to hold rates unchanged at 5.1 per cent, some would have supported a 25 basis point hike.

"The minutes paint a picture of an increasingly divided committee as it becomes more difficult to navigate the pace and intensity of policy moves," St George chief economist Besa Deda said.

Materials stocks were some of the worst performers on the ASX, down 1.9 per cent after a "disastrous night" for commodity prices, says Eightcap market analyst Zoran Kresovic.

Given the high density of miners in the Australian economy, the falling price of iron ore and base metals overnight weighed heavily on the wider market.

"The other thing that we're seeing is a little bit more narrative over tensions between the US and China, which obviously always plays a big part in terms of the global economy," Mr Kresovic told AAP.

Softer-than-expected Chinese manufacturing released on Wednesday fanned fears Australia's largest trading partner is heading towards an economic slowdown.

Given those macroeconomic concerns, a sell-off on the ASX was to be expected, Mr Kresovic said.

Some profit-taking was likely also a factor after the index experienced an uptick in the past two weeks.

Heavyweight miners BHP, Fortescue and Rio Tinto slid 2.3 per cent, 1.7 per cent and 1.4 per cent respectively. Goldminers Newcrest and Evolution were 1.5 per cent and 2.6 per cent lower respectively.

Financials also had a disappointing day with the big four banks all down. CBA fell 1.3 per cent to $100.43, Westpac dropped 1.7 per cent, ANZ retreated 1.9 per cent and NAB was 2.1 per cent lower.

Magellan Financial plunged 8.3 per cent after disclosing $2.1 billion in net outflows for the month of June.

The consumer discretionary sector was another big loser, down 1.9 per cent, while tech stocks provided the only bright spot, inching 0.1 per cent higher.

Car accessory retailer ARB dropped 4.3 per cent, Myer sank 4.6 per cent and 3.2 per cent was sliced off of Domino’s Pizza shares.

In more bad luck for Star shareholders, the embattled casino operator fell 8.7 per cent after announcing the appointment of former ANZ chief risk officer Peter Hodgson to its board.

There was better news for Block shareholders, with the Square mobile payment system owner up 3.9 per cent.

Medicinal cannabis and psychedelics developer Incannex finished on a high, jumping 4.8 per cent after receiving ethics approval to start clinical trials for a sleep apnoea drug.

IT consultancy Cirrus shot up 14.7 per cent to a three-year high of 3.9c after booking an eight per cent boost to revenue for 2022/23.

Baby formula producer Bubs Australia fell 2.2 per cent after unveiling a new strategy designed to milk the lucrative Chinese market.

The Australian dollar was down against its US counterpart, buying 66.62 US cents from 66.86 at Wednesday’s ASX close.

ON THE ASX:

* The benchmark S&P/ASX200 index finished Thursday down 89.8 points, or 1.24 per cent, at 7,163.4.

* The broader All Ordinaries fell 88.1 points, or 1.18 per cent, to 7,365.

CURRENCY SNAPSHOT:

One Australian dollar buys:

* 66.62 US cents, from 66.86 US cents at Wednesday’s ASX close

* 95.79 Japanese yen, from 96.74 Japanese yen

* 61.37 Euro cents, from 61.45 Euro cents

* 52.40 British pence, from 52.62 pence

* 107.64 NZ cents, from 107.89 NZ cents.