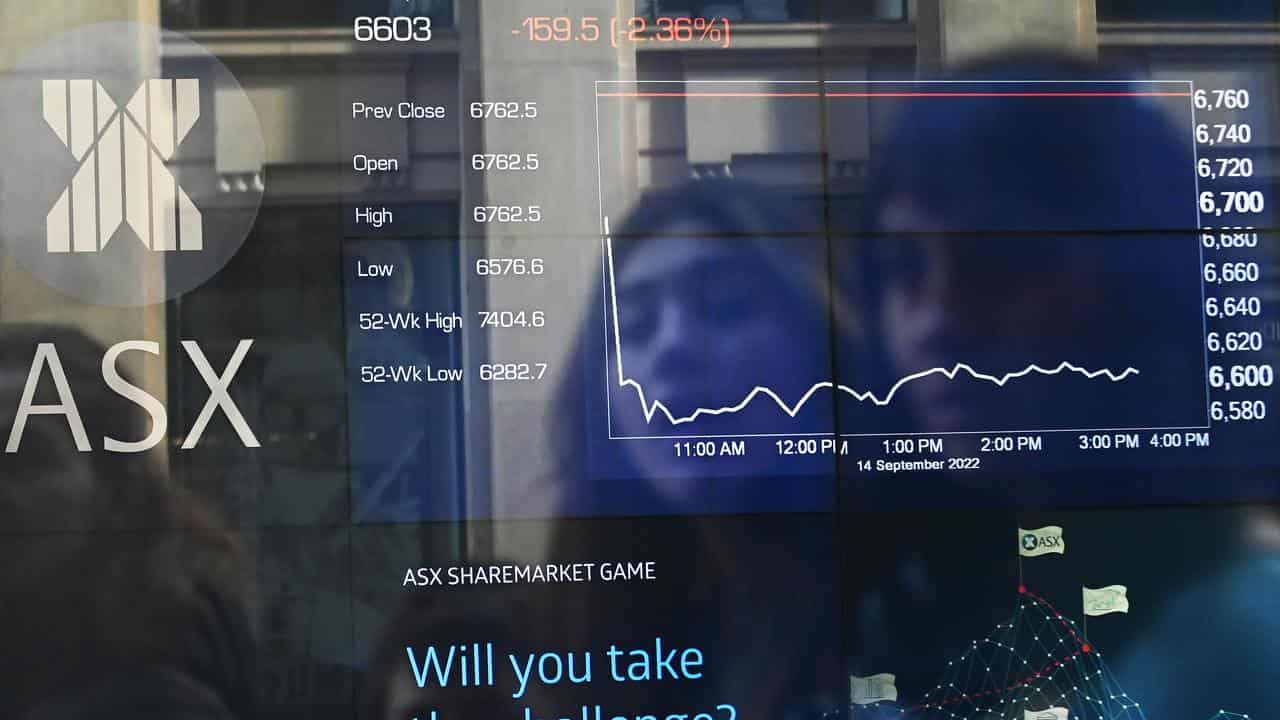

The Australian share market has dropped precipitously for a second day, closing at two-and-a-half week low amid the spiralling conflict in the Middle East and soaring US bond yields.

The benchmark S&P/ASX200 index on Friday finished down 80.9 points, or 1.16 per cent, to 6,900.7, while the broader All Ordinaries fell 83 points, or 1.16 per cent, to 7,089.7.

The close was the ASX200's third lowest of the year, only exceeded on October 4 and March 20, leaving it down 2.1 per cent for the week and 2.0 per cent for the year.

"There are several reasons why investors would want to sell this market, while very few to buy," said Capital.com market analyst Kyle Rodda.

"That’s what we’ve seen today as risk sells off."

In the Middle East, security officials were signalling their readiness to launch a weekend ground offensive into Gaza that they said would be far more ferocious and comprehensive than anything seen before.

In the Red Sea, a US guided missile destroyer the USS Carney shot down three missiles and several drones launched by Houthi forces in Yemen that officials said were potentially headed towards targets in Israel.

Meanwhile US 10-year Treasury yields jumped eight basis points to a 16-year high of just a touch under five per cent following a speech by Federal Reserve chairman Jerome Powell, while short-term yields fell.

St George senior economist Jarek Kowcza said the powerful central banker had walked a fine line, suggesting that a rate hike next month was unlikely while emphasising that additional hikes may be needed in future given the resilience of the US economy.

"It’s a challenging environment for stocks to rise when risk-free rates are this high," Mr Rodda commented.

Every ASX sector closed lower except for energy, which rose 0.2 per cent as the Middle East conflict pushed Brent crude up to a three-week high of $US93 a barrel.

The mining sector was the biggest loser, down 1.7 per cent as BHP dropped 1.8 per cent to $44.43, Fortescue fell 2.2 per cent to $21.39 and Rio Tinto retreated 0.7 per cent to $114.62.

Also, Liontown Resources had plunged 31.9 per cent to a seven-month low of $1.90 after raising $365 million at a deep discount of $1.80.

The capital raising, which will be used to fund the company's globally significant Kathleen Valley lithium project in WA, comes just days after US lithium giant Albemarle walked away from its $3-per-share takeover offer for Liontown following Gina Rinehart’s Hancock Prospecting acquiring a significant stake in the company.

Goldminers Northern Star and Evolution rose 1.3 and 2.2 per cent, respectively, as the safe haven asset traded at a three-month high of $US1,980 an ounce - or an all-time high of $3,136 in Australian dollars.

All the Big Four banks finished lower, with NAB falling 1.6 per cent to $28.65, CBA dipping 1.0 per cent to $98.75 and Westpac and ANZ both retreating 1.4 per cent, to $20.86 and $25.27, respectively.

Insignia Financial fell 12.8 per cent to an all-time low of $2.04 after announcing that "by mutual agreement" chief executive Renato Mota would step down in February after 20 years with the financial advice company formerly known as IOOF, the last five as its CEO.

Cleanaway Waste Management fell 1.3 per cent to $2.35 as the waste management company forecast $350 million in earnings for 2023/24, with CEO Mark Schubert reporting a strong start to the new financial year.

The Australian dollar was buying 63.10 US cents, from 63.09 US cents at Thursday's ASX close.

ON THE ASX:

* The S&P/ASX200 index finished Friday down 80.9 points, or 1.16 per cent, at 6,900.7

* The All Ordinaries dropped 83 points, or 1.16 per cent, to 7,089.7

CURRENCY SNAPSHOT:

One Australian dollar buys:

* 63.10 US cents, from 63.09 US cents at Thursday's ASX close

* 94.57 Japanese yen, from 94.49 yen

* 59.71 Euro cents, from 59.87 Euro cents

* 52.11 British pence, from 52.00 pence

* 108.37 NZ cents, from 108.21 NZ cents