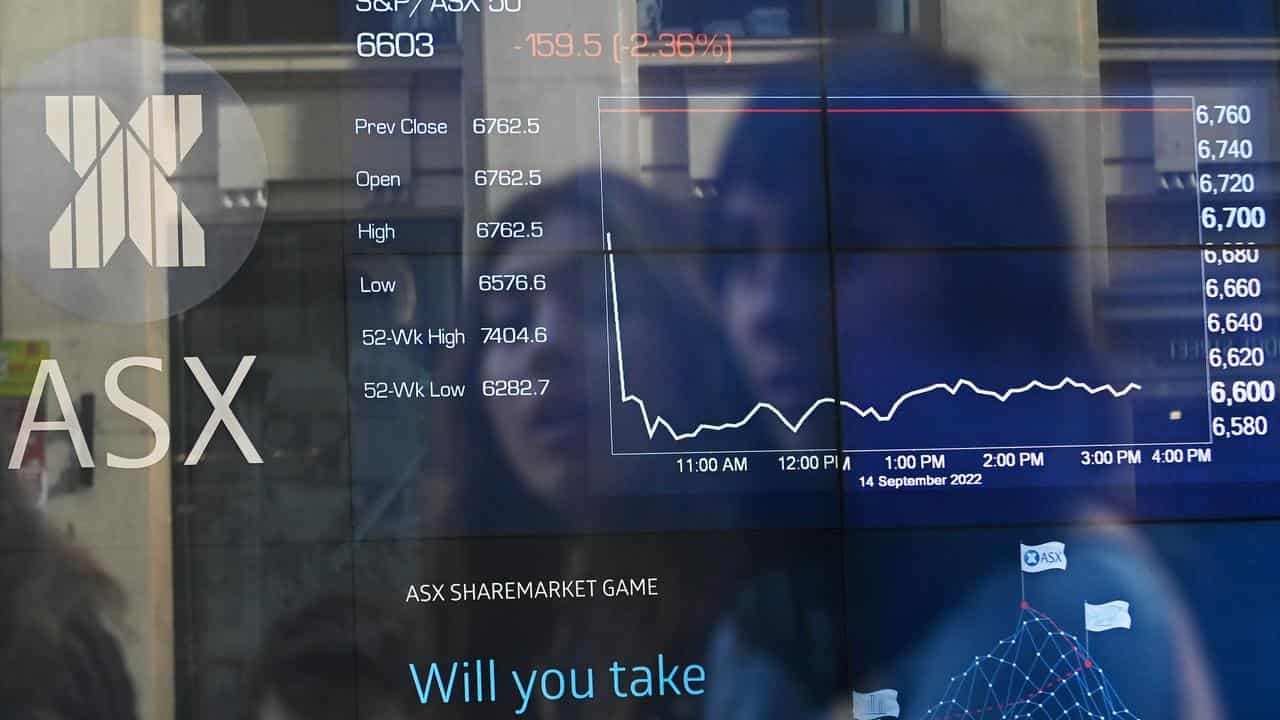

The local share market has suffered its worst loss in a week and a half as traders digested gross domestic product figures that showed the Australian economy growing, but at a subdued pace.

The benchmark S&P/ASX200 index on Wednesday finished 57.2 points lower at 7,257.1, a drop of 0.78 per cent, while the broader All Ordinaries fell 55.2 points to 7,461.1, down 0.73 per cent.

The indexes started the day in the red but fell further after the Australian Bureau of Statistics reported the country's economy grew 0.4 per cent in the June quarter and 2.1 per cent in 2022/23, while also revising March quarter growth higher.

CommSec chief economist Craig James said that the figures showed a weak economy masked by population growth, business and public investment and exports. Labour productivity was a "shocker," he added.

That weak productivity growth means that unit labour costs are still running high, HSBC economists Paul Bloxham and Jamie Culling wrote, and therefore there's a risk that the Reserve Bank will need to raise the cash rate further to get inflation back to target in what it deems a reasonable timeframe.

The economists said their "central case" was for one more rate hike in the fourth quarter - which isn't what the market is hoping for.

Every sector of the ASX fell except for energy, with tech stocks the worst hit, collectively dropping 1.5 per cent.

The heavyweight mining sector was down 0.8 per cent, with BHP flat at $46.10, Fortescue adding 1.5 per cent to $20.34 and Rio Tinto falling 1.1 per cent to $115.98.

All of the Big Four banks closed in the red, with Westpac dropping 1.6 per cent to $21.19, NAB falling 1.2 per cent to $28.66, CBA down 0.7 per cent to $101.51 and ANZ closing 0.6 per cent lower at $25.06.

Also, Macquarie fell 3.8 per cent to $170.21 as the investment bank released a first-quarter update noting lower investment-related income from green energy investments, although it expects more asset realisations in the second half.

In the energy sector, Woodside Energy added 1.3 per cent to $38.52 and coal miner Yancoal climbed 2.0 per cent to $5.12.

The Australian dollar was buying 63.83 US cents, up from 63.75 at Tuesday's ASX close but still not far from its lowest level since last November.

ON THE ASX:

* The S&P/ASX200 index finished Wednesday down 57.2 points, or 0.78 per cent, at 7,257.1.

* The All Ordinaries dropped 55.2 points, or 0.73 per cent, to 7,461.6.

CURRENCY SNAPSHOT:

One Australian dollar buys:

* 63.75 US cents, from 63.75 US cents at Tuesday's ASX close

* 94.13 Japanese yen, from 93.63 Japanese yen

* 59.48 Euro cents, from 59.19 Euro cents

* 50.81 British pence, from 50.65 pence

* 108.52 NZ cents, from 108.37 NZ cents