A much-ballyhooed "open banking" regime has been a costly, little-used flop that has hindered competition rather than helping it, according to an industry association-funded strategic review.

The report by Accenture found that 0.31 per cent of bank customers had an active data-sharing arrangement under Australia's Consumer Data Right rules at the end of 2023, four years after the system was launched.

That is even though the banking industry had invested $1.5 billion since 2018 to make customer data accessible to third parties, such as money-management apps and lending services, the report says.

Banks were forced to make that investment under the legislation passed by the Turnbull government in the wake of the banking royal commission.

Then-treasurer Scott Morrison said in his 2017 budget speech that the introduction of open banking would "give customers greater access to their own data, empowering them to seek out better and cheaper services."

Mr Morrison also promised in 2018 that open banking would disrupt the major banks' stronghold on data, making the process of switching between banks less painful.

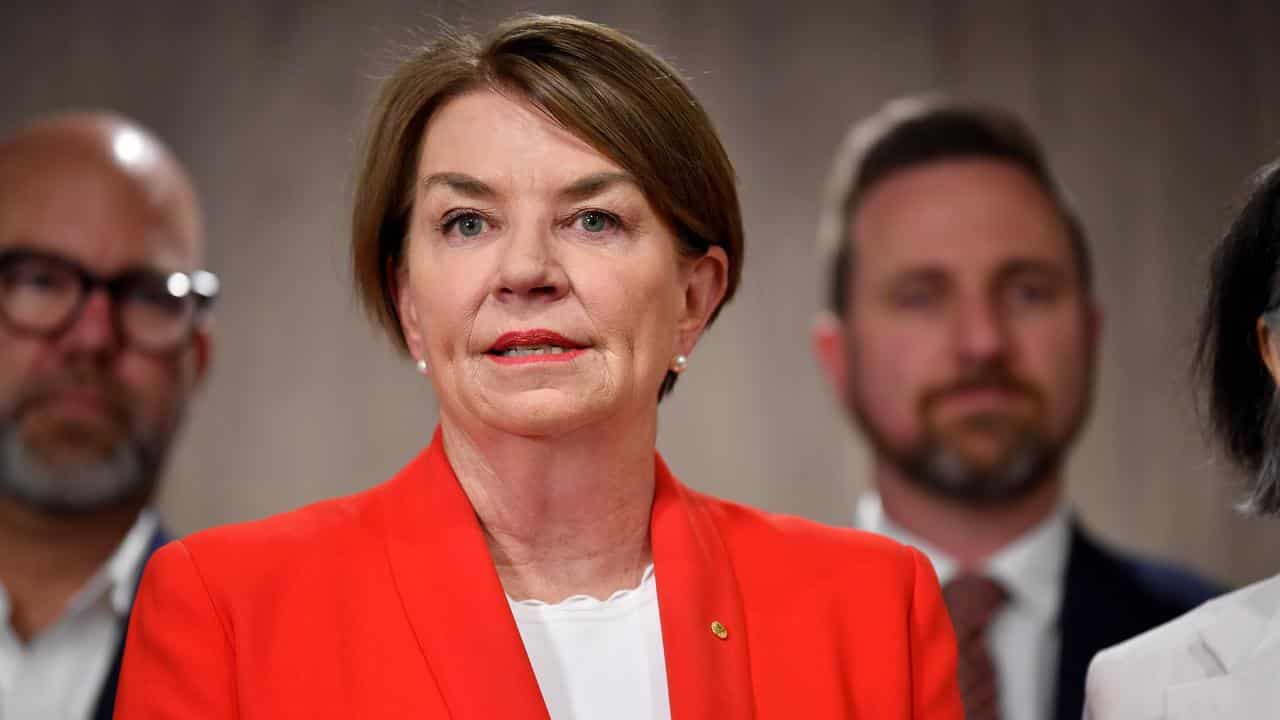

But Australian Banking Association chief executive Anna Bligh said the review, which her organisation funded, made it clear that despite the best efforts of government, regulators and industry, the Consumer Data Right (CDR) had not realised its potential.

"Australians have enthusiastically embraced digital innovations in banking such as mobile wallets and PayID, however, uptake of the CDR has been comparatively low," she said.

“It’s time to go back to the drawing board. The current CDR regime isn’t delivering for customers or enhancing competition and a new pathway forward is needed.”

Customer Owned Banking Association chief executive Michael Lawrence said that customer-owned banks had collectively invested over $100 million into open banking, with very little benefit to customers or competition.

“While we support the intent of the CDR to increase competition, it has actually made it more difficult for smaller banks to compete by tying up resources with little to no tangible return,” Mr Lawrence said.

The biggest user of the open banking system has been Frollo, a money management app, followed by WeMoney, a platform for paying down debt, and Flamingo, a financial wellness and savings app.

However, FinTech Australia CEO Rehan D'Almeida said the 0.3 per cent adoption figure spoke only to the number of Australians who were actively connected to the CDR system via their bank accounts and using it on an ongoing basis.

The figure did not include lenders such as mortgage brokers who connect to the CDR system via single-use access for data to help assess loans, Mr D'Almeida said.

Figures for single-use access are not publicly available and he encouraged the Treasury and Australian Competition and Consumer Commission to release that information.

"This would enable the ecosystem to holistically measure success, understand the most popular use cases, and celebrate the CDR being used to deliver benefits to consumers," Mr D'Almeida said.

Mr D'Almeida added that other parts of the open banking legislation have not been passed and promotion would be key for the CDR to see broader adoption.

"History has shown that the 'build it and they will come' mentality with fintech won't work," he said.